In the modern world that is characterized by a high rate of activity, it is always possible to experience a financial crisis. It can be a medical bill, an emergency repair of the home, or a sudden bill, and having easy access to cash is essential. The good news? It is now possible to take a How to Get a ₹10000 loan on an Aadhaar card without the inconvenience of long paperwork and submission of several documents. The Aadhaar card is an Indian identity card, and it has become a potent tool for getting instant credit.

This radical transformation in lending has enabled small loans to be more available to millions of Indians, particularly those who might lack proper income evidence or large records. We are going to take you through all the need-to-know in this all-inclusive guide on how to get a 10,000 loan with only the presence of your Aadhaar card.

What Is a ₹10,000 Loan on Aadhar Card?

A micro-loan facility called a ₹10,000 loan on an Aadhaar card is a micro-lending service where your Aadhaar number serves as the primary identification document to take the loan. These are usually unsecured personal loans that are provided by digital financing agencies, NBFCs (Non-Banking Financial Companies), and a few banks.

Aadhaar-based e-KYC (Know Your Customer) authentication provides the loan process with the opportunity of instant verification of your identity using either a biometric or an OTP-based authentication. This is a digital-first strategy that has removed the necessity of submitting documents physically and visits to the bank, and made the process smooth and fast.

Why It’s Popular

- Instant Approval: The majority of the applications are done within minutes, and money is released within hours, as opposed to days or weeks.

- Little Paperwork: Aadhaar-based loans do not need a lot of paperwork as compared to conventional loans, which require various documents.

- No Securities: As unsecured loans, you will not have to provide any security in the form of assets or property.

- Digital Convenience: Use it wherever you are through your smartphone and not in a bank hall.

- Financial Inclusion: Assists credit-free and formally employed persons to gain emergency funds.

- Flexible Repayment: The tenure period options of short tenure are 7 days to 12 months, depending on financial conditions.

Eligibility to Get a ₹10,000 Loan on an Aadhar Card

Common Eligibility Criteria

- Age: Applicant must be between 18 and 65 years old when the application is made.

- Indian Citizenship: The loans can only be availed by Indian citizens with valid Aadhaar cards.

- Active Mobile Number: The mobile number registered with Aadhaar should be active in order to verify OTP.

- Bank Account: You will be required to have a functional savings or current account in your name for the disbursal of the loan.

- Credit Score: Although there are lenders who accept a low credit score, a CIBIL score of 600 and above gives one a high chance of being approved.

- Residential Proof: A permanent residential address which can be authenticated by Aadhaar or utility bills.

Can You Get This Loan Without Salary Proof?

Yes, most lenders are now able to provide loans without the conventional slips of salary. The self-employed, people who work on a gig basis, and people who are not formally employed can apply. Banks have alternative data aspects such as bank statement analysis, digital footprint, and transaction history to determine creditworthiness.

Nevertheless, production of some kind of income evidence, including the bank statements which indicate regular deposits, GST returns in the case of businesses, or even daily UPI withdrawals, can go a long way toward enhancing your chances of approval and can result in more favorable interest rates.

Aadhaar Alone — Is It Sufficient?

Although Aadhaar is the foundation document for these loans, it is generally not the sole requirement. Financial verification and income tax will require that most lenders look into your PAN card. Also, they will check your bank account and mobile phone number that you are connected with.

The Aadhaar-only marketing can be interpreted to mean that it is the main document to verify identity; nevertheless, the entire process involves verifying your banking habits, credit score, and online presence. Imagine Aadhaar as the key to unlocking the door, but lenders would still prefer to get a glimpse of what is inside before granting your loan.

Step-by-Step: How to Apply Online for a ₹10,000 Loan on Aadhaar Card | Online Application Process

The process of learning how to Get 10000 loan on aadhar card via the online method is simple when you take recourse to the following specific steps:

Step 1: Select Your Lending Platform Research

Pick a reputable lending application or a bank that provides Aadhaar-based loans. Reviewing checks, interest rates, and customer feedback prior to doing so. Seek RBI registration, quality of customer service, and terms and conditions transparency. Read reviews and forums on Google Play Store or Trustpilot to get to know what other borrowers went through.

Step 2: Discover the App or Go to the Website

Install the Google Play Store or Apple App Store official app, or access the official site of the lender on your browser. Make sure to download the original app by reviewing the name of the developer, as well as having verification badges. Do not use third-party application stores or phishing links.

Step 3: Create Your Account

Jot down your mobile number and authenticate it using OTP. Register a safe password and do the first step of registration. The password should be composed of letters, numbers, and special characters. This cell phone number will be your main contact on any matters related to the loan, thus make it active and available.

Step 4: Finalize Aadhaar e-KYC

Enter your 12-digit Aadhaar number and authenticate it by means of OTP sent to your Aadhaar-linked mobile number or by means of biometric authentication. The e-KYC is a quick and safe procedure that employs the authentication system by UIDAI. Ensure that your Aadhaar mobile number is working because it is only this number that you will be receiving the OTP.

Step 5: Enter PAN card number

Enter a PAN card number to verify financial information. This assists lenders in scrutinizing your credit check and tax history. The system will authenticate your PAN and retrieve your credit report with the credit bureaus, such as CIBIL, Experian, or Equifax, immediately. Make sure that your PAN and Aadhaar information are the same.

Step 6: Add Bank Account

Enter your bank account information into which you want the loan amount to be deposited. On certain sites, this is immediately verified via the penny drop method, where the site deposits a small payment (typically 10%) and subtracts it to ensure that the account is valid. Please select your bank account number, the IFSC code, and the account holder’s name.

Step 7: Select Loan Amount and Tenure

Choose ₹10,000 as your loan amount and select a comfortable loan repayment period depending on your own financial capacity. The platform will show various tenure plans (usually 1 month to 12 months) and respective EMIs of the same. Take the EMI calculator that is given and determine what you will be responsible for monthly.

Step 8: Sign Terms and Repayment Schedule

Make certain to read the processing charges, interest rate, and repayment schedule carefully. Accept the terms and conditions, and send in your application. Particular attention should be paid to the annual percentage rate (APR), pre-closure charges, late payment damage, and the conditions of auto-debiting. Save the loan agreement and download it.

Step 9: Waiting for Approval

The system will pass your application through credit scoring algorithms. The greater part of the approvals is made within minutes to several hours. In the process, the AI of the lending company examines your credit score, bank statement behavior, debt-related liability, and ability to pay. You will get a notification of your application status through SMS and app notifications.

Step 10: Receive Funds

Once the ₹10,000 is approved, the ₹10,000 will be automatically deposited into your linked bank account, most of the time within a few hours or 24 hours. You would get a confirmation message on the loan account number, EMI schedule, and the first payment date. All upfront costs, such as processing fees and any other charges, will be removed from the approved amount and disbursed.

Step 11: Repayment

Once repayment is auto-debitable or e-NACH, you will need to get your bank account linked to the repayment to make payments on time. This eliminates defaulted payments and related fines. Add the EMI due date to your calendar and keep an adequate balance in your account one day prior to the EMI due date.

Required Documents

Mandatory Documents

- Aadhaar Card: Aadhaar number Active mobile linkage with 12-digit Aadhaar number.

- PAN Card: Permanent Account Number used to identify and perform financial checks.

- Bank Account Information: IFSC, account number.

- Mobile Number: The number for your Aadhaar card-registered and active mobile number.

- Photograph: New passport-size photograph (can be taken automatically using the app in some instances)

Commonly Requested Additional Docs

- Bank Statements: 3-6 months’ statements to confirm the patterns of income and transactions.

- Address Proof: Utility bills, rental agreement, or voter ID when Aadhaar address is not the same as the current residence.

- Proof of Income: Slips of salary, Form 16, ITR, or income statement of business (but not always compulsory)

- Employment Information: company name, title, work email address of persons working in the company on a salaried basis.

- References: Name, address of 2-3 referees who can testify on your credit.

Interest Rates, Fees & Repayment

Interest Rates

The interest on a 10000 loan on aadhar card is charged at a rate of 12-36% percent per annum on the loan amount, depending on your credit score. Individuals with a high credit score (750 and above) will get charged as low as 12-18%, and those with a bad credit history may be charged as high as 36%.

The monthly interest on digital lending applications is usually 1.5% to 3%. It is always good to add up the interest that you will pay over the tenure of the loan and then accept the offer. There are platforms with reducing balance calculations that are more preferable to those with flat rate calculations.

Processing Fee & Charges

The majority of the lenders charge between 1-5% of the loan, and therefore, it would cost ₹100-500 in case of a loan of ₹10,000. This payment is often charged at the outset of the payment.

Also, beware of such hidden costs as documentation fees (₹50- 200), GST on processing fees (18%), platform fees, and insurance charges. There are also late payment fees of ₹100 to ₹ 500 on EMIs that are late and a penalty interest of 2-3% on the outstanding loan.

Repayment Tenure & EMI

Microloans have a short repayment period of between 7 days and 12 months. In a ₹10,000 loan, where interest rates are 24% per annum, and the loan is being disbursed in the first half of the year, the EMI on the loan would be around ₹1,780 every month. The shorter the tenure, the greater the EMIs and the less the total interest, whereas the longer the tenure, the less the EMI burden and the more the overall interest cost.

The majority of the platforms provide the ability to pay with flexibility, either using auto-debit from your bank account, UPI, or manual transfers. Select a tenure that fits well in your budget monthly to avoid defaults.

Top Ways to Get a ₹10,000 Loan on an Aadhaar Card Online (2026)

Digital Lending Apps & Platforms

Popular Lending Apps:

- MoneyTap: Line of credit facility: Instant loans by credit line based on KYC, using Aadhaar card, interest rate as low as 13% per annum.

- CASHe: Salary advance loan that offers loans to the tune of ₹4 lakh at a low level of documentation and is disbursed promptly.

- EarlySalary: Catering to competitive rates and flexible repayment arrangements for professionals with a salary level.

- PaySense: Provides personal loans that are verified by Aadhaar and are approved within minutes.

- KreditBee: First-time borrowers should get a popular app with easy eligibility and instant appraisals.

NBFC Platforms:

- Bajaj Finserv: NBFC, which has been established and provides pre-approved loans by Aadhaar e-KYC.

- Tata Capital: offers personal loans on an instant basis and with an online application.

- Fullerton India: Instant loans using the Aadhaar card and at attractive interest rates.

Traditional Banks with Aadhaar e-KYC

Leading Bank Options:

- HDFC Bank offers Insta Loans through its mobile application through Aadhaar authentication. Pre-qualified clients receive immediate approval, low interest rates of approximately 10.5% p.a., and quicker processing for those with existing accounts.

- ICICI Bank has Instant Personal Loans that are handled in a totally paperless, fully digital manner. Customers who have been pre-approved get money in a few seconds. It is convenient due to flexible repayment options and convenient to top up.

- State Bank of India (SBI): offers Xpress Credit in the YONO application. Interest rates are around 11% p.a. SBI integrates digital convenience and branch support in helping customers.

- Axis Bank: allows instant loans by means of mobile and internet banking with Aadhaar authentication. Options such as fast approvals, liberal terms, and physical document assistance are provided.

- Kotak Mahindra: Bank. It offers digital personal loans through the 811 platform. It has minimal paperwork, transparent charges, and rates usually between 10.99% to 18.

- Alternatives: There are other alternatives that provide fast-digital loan services, and they include Yes Bank, IndusInd Bank, and Idfc First Bank.

Banks usually have lower interest rates (10.5%-16%) than fintech apps, and could include stricter eligibility criteria. They like to maintain their old customers and have good relations with the bank, and can also demand a minimum credit score of 650-700.

The benefit of selecting banks as How to Get 10000 loan on aadhar card is the higher level of security, the mechanisms of customer complaints, and more transparent terms in general. Nonetheless, it may take a bit longer to be approved than fintech apps, and it may only be available to account holders.

Alternative Options for ₹10,000 Loans

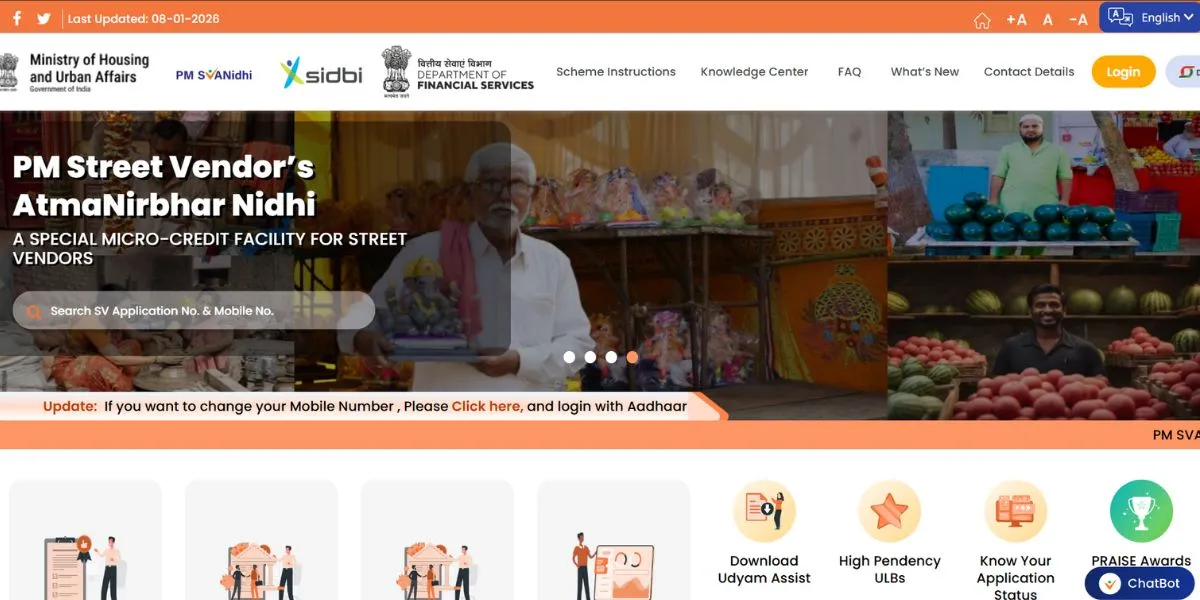

Government Scheme: PM Svanidhi (for Street Vendors)

The PM SVANidhi (Prime Minister Street Vendor Atma Nirbhar Nidhi) scheme is a credit scheme specially designed to support COVID-impacted street vendors. It offers working capital loans of up to ₹10,000 without collateral and at subsidized interest rates.

Loans are offered at an interest rate of 7% per year to eligible vendors with an interest subsidy of 7% given by the government to loans repaid on time. It is an Aadhaar-based authentication scheme that is accessible at specific lending institutions. It is a great alternative for people in the informal sector who fit the requirements of the vendor.

Emergency Micro-Credit Apps

- Dhani: Provides instant loans up to ₹15,000 with Aadhaar authentication, deposit in 10 minutes, and can be used in case of emergency spending.

- Nira: Small ticket loans, flexible repayment, targets first-time borrowers with limited credit history.

- mPokket: is aimed at students and young professionals, offering loans between ₹500 and ₹30,000.

- Kissht, pay later platform, also provides cash loans with instant verification based on Aadhaar.

- Fibe (used to be EarlySalary): Rapid loans and very basic documentation and credit score through AI.

- Aye Finance: Micro-e Micro-enterprisewith an alternative credit scoring model other than CIBIL checks.

Safety, Risks & Precautions

Safety Measures to Follow

- Confirm the Legitimacy of Lenders: Only legitimize NBFCs registered by the RBI or licensed banks. Enquire about lender registration at the RBI site.

- Check Terms Carefully: Before signing the loan contract, make sure you know all charges and interest rates, as well as the terms of repayment.

- SAFE Personal Information: Do not disclose Aadhaar OTP, bank PIN, or passwords to anybody saying to be a representative of a lending company.

- Check App Permissions: It is important to make sure that the lending app asks only the essential permissions and does not access unnecessary data.

- Use Authoritative Sources: Only download apps in official application stores and use verified websites.

Common Risks to Avoid

- Predatory Lending: There are apps that have outrageous interest rates (up to 200-300% per annum). Always divide the effective annual rate.

- Invasion of Privacy: There are those applications that harvest too much individual information about your phone, such as contacts, messages, and photos.

- Processing Fee: Be alert to processing fees, insurance premiums, and other non-obvious charges.

- Harassment Tactics: There are those lenders who employ hard-sell techniques, such as calling contacts and humiliating them in front of the crowd about defaults.

- Data Security: The lenders who are not regulated might not have proper data protection, and they can be exposed to identity theft and fraud.

Best Practices

- Select at least 3-4 lenders for How to Get a 10000 loan on aadhar card.

- Ensure that you have a good credit score through the payment of outstanding EMIs in due time.

- You should only borrow in a manner you feel comfortable paying back within the tenure.

- You should automatically debit so that you do not miss EMI payments and late fees.

- Store all loan-related documentation and communication records for reference.

- Note any doubtful lending behaviours to the complaint portal of the RBI.

Conclusion

The concept of How to Get a ₹10000 loan on an Aadhar card has become extremely vital in a digital economy. Technology has transformed the process, resulting in emergency funds being available to millions of people who were not able to cope with the traditional banking systems. Although it is a fact that the convenience of loans based on Aadhaar is undeniable, responsible borrowing will always be first. Always calculate your ability to repay any form of loan, no matter how simple the process may have appeared to be.

Investigate lenders and their actual borrowing terms; how much they charge for regular loans, and have flat-rate (one-time) loan fees. In other words, average their charge (e.g., ₹10,000) into your interest rate at least, so your borrowing fees are properly accounted for in the loan. After you understand the cost of each loan,n; how much it will affect your credit score, and how many lenders will be able to help you, specifically if you default, it is almost time to compare your interest rate and the lender’s ability to lend you money for a normal loan or amount.

So use these loans only if you have to, and your goal is to pay them back on time (within 30 days tops) and build on your future credit history so that you can continue to meet your larger goals in the financial world (tomorrow). The power of instant credit depends upon your ability to manage finances professionally and maintain an appropriate balance.

FAQs

Will I be able to take a ₹10,000 loan through an Adhara card withoutay credit score?

Yes, there are some online lenders that issue loans to first-time borrowers who have no credit history. Nevertheless, the interest rates could be higher, and the approval will be based on other data, such as the bank statement analysis and the verification of the digital footprint.

What is the duration to receive the amount loaned after receiving the loan?

After the approval of your application for a How to Get 10000 loan on aadhar card, the money is disbursed by most of the lenders within 2-24 hours to your bank account. Certain instant lending applications are able to credit the money within 10-30 minutes to those customers who are verified to be genuine.

Can I share my Aadhaar information with lending applications?

No harm, provided that you work with registered and reputed lenders at the RBI. Do not, however, give your Aadhaar OTP to anybody on the phone or email. Do not manually fill in the fields in the official app or site when going through the e-KYC procedure.

What if I am not able to pay the loan on time?

Defaulting repayment means attracting late payment fees, interest penalties, and a bad credit score. Recovery is also possible by lenders suing. It is always good to call your lender at least one day prior to the due date in case you have trouble repaying them.

Will I be able to take up several ecosystems (i.e. _10,000 loans) with various apps?

Practically possible but much discouraged. Borrowing more than one loan at a time will compound your level of debt and will significantly ruin your credit rating. The application of every loan leaves a hard inquiry into your credit report, and multiple loans show credit hunger, which is perceived as a negative factor by future lenders.