With its reputation as a Focus on pharmaceuticals, IT and culture spread across the world, Hyderabad is now establishing a very strong footprint in the financial services arena of India. This has seen the city host an increasing number of fintech startups, Non-Banking Financial Companies (NBFCs) and payment solution providers that facilitate managing money by the average citizen. Still a salaried professional or a student or a small business owner, the emergence of finance companies in Hyderabad presents you with a wider variety of options, greater flexibility and faster accessibility to the business into financial services than ever before.

This growth is supported by the figures. However, Hyderabad has now emerged as one of the top five fintech centres in India, along with Bangalore, Mumbai, Pune and Delhi NCR as indicated in a NASSCOM 2023 report. India is expected to see a rise of the fintech market up to a $150-billion difference by 2025, and the operations of the fintech companies based in Hyderabad are greatly contributing to that perspective.

Increased practical benefits to customers go with this boom. Indicatively, the PhonePe, with huge office units in Hyderabad, clears over 4.5 billion transactions per month via UPI. Meanwhile, CreditVidya, a Hyderabad based Fintech Company is destroying credit access by enabling lenders to assess individuals without standard credit histories.

In Hyderabad, there is a transition of the slow and paper-comprised customer experience to digital first. Apps can be used today to apply in seconds to a personal loan or pay bills or even to secure working capital in a small business. It has not only resulted in fiscal services being affordable and transparent to many but also easy to a greater number since this transformation.

Through this blog, we will learn about the top 10 finance companies in Hyderabad that will define the manner in which customers borrow, save, drive investments, and make transactions in the year 2025. Every company description is customer focused in the sense that you will find how these businesses can simplify your finances.

Why Hyderabad is a Rising Financial Hub

The development of finance companies in Hyderabad does not happen by chance. The city is characterized by a great concentration of tech innovators, government-supported projects, and an enormous and young customer base willing to go digital. Such a combination has lured new players as well as old ones to establish themselves in the city.

To the customers this means increased adoption rate of new products. Starting with instant loan lending of digital money and engaging payment mechanisms and innovative credit scorecard models, Hyderabad residents frequently have access to the latest financial solutions long before the rest of the nation receive them. Financial innovation reaches businesses and individuals alike due to the balance of the traditional industries (such as pharma and manufacturing) and the modern IT and financial technology.

List of Top 10 Finance Companies in Hyderabad

1. Payswiff

- Founded year: 2013

- Headquarters: Hyderabad

- Website URL: https://payswiff.com

It is one of the top finance companies in Hyderabad, covers digital payments and merchant solutions under the Payswiff title. You might not see it day-in, day-out, but Payswiff does incredibly much work to ensure your debit or credit card functions at the local shops, restaurants, and small business enterprises.

The corporation offers POS (Point-of-Sales) devices and mobile POS machines which will enable merchants to take payments in card, UPI, and wallet modes. This translates to an easy time shopping without having to mind the cash to the customers. Payswiff also has the capability of driving digital payments into the businesses of merchants in Hyderabad and other parts of the globe thus expanding digital payments.

The best thing about the Payswiff is its determination to create payment facilities in the small traders and kirana shops. This is more convenient to customers within neighborhoods that used to have no access to traditional POS machines in the past. The increased currency system of the more merchants using Payswiff, customers experience a greater availability of cashless payments in their day-to-day purchases.

Furthermore, Payswiff is growing into offering value-added service with EMI option on check-out, pay bills and perform mobile recharges. This offers the customers greater flexibility in shopping or paying bills. To the inhabitants of Hyderabad, Payswiff is the cornerstone to the hassle free system of digital payments.

Financial Services:

- Merchants can receive payments through the Omni-channel (POS, mPOS, UPI, QR, etc).

- White label / branded POS and payment solutions to banks / enterprises (“Payments in a Box off the Shelf”, Tatkaal-POS etc)

- Services infrastructure (payment infrastructure, technology) (KYC management settlement stacks back-end payment processing)

- GST / Tax filing / invoicing / merchant accounting systems (GST return filing, the preparation of sales and purchase invoices, etc)

2. CreditVidya

- Founded year: 2012

- Headquarters: Hyderabad

- Website URL: https://www.creditvidya.com

CreditVidya is a Hyderabad based fintech company, specializing in alternate credit scoring. To the customers, the latter is groundbreaking- particularly to the customers who may lack traditional credit history or have a high credit score.

Lenders tend to turn down clients with a credit score that fall below rigid credit score thresholds. It is addressed by CreditVidya who considers unconventional data like mobile bill payments, and digital activities, as well as behavioral patterns, to influence the credit acceptance measure. This opens the door to large numbers of first-time borrowers, gig employees or semi-urban/rural folks, who have previously had no access to formal credit.

This will ensure that customers in Hyderabad have greater chances of approval and receiving loans and credit cards or BNPL (Buy Now Pay Later) providers. Have you ever been frustrated when you turn up seeking a loan yet your income is stable, CreditVidya provides you with a second opportunity.

CreditVidya collaborates with banks and NBFCs, and as a borrower, you do not directly engage with them, but it is their technology to ensure that lenders are capable of advancing you in a more balanced and expedited manner. CreditVidya assists in creating financial inclusion by providing more individuals access to credit, and enabling individuals to take charge of their financial future.

Financial Services:

- Alternate-data credit scoring/underwriting (to lenders) in order to mitigate borrowers not with complete traditional bureau history.

- To minimize fraud and expedite underwriting apply employment verification / background verification tools (e.g. form-checking salaried persons)

- Full lending stack based on API that allows partner lenders (origination – underwriting – collections) to integrate credit products through APIs.

- Email checking / rule engines / digital image / authorizing services to find out the authenticity of borrower data.

3. CredRight

- Founded year: 2016

- Headquarters: Hyderabad

- Website URL: https://www.credright.com

CredRight is an NBFC located in Hyderabad which specializes in small business and self employed professional loans. In the case of customers that operate shops, trade businesses or services; CredRight should be considered as an ally when the bank is not ready to offer assistance without collateral. The company offers business loans without collatals, thus simplifying business people and micro-enterprises to access working capital.

The customers will ascend loans between 1 lakh to 10 lakh where repayment can be done at their discretion. Approval is swift and less complex as compared to banks and CredRight relies on alternate data models to assess businesses. The effects of CredRight can not be erased on ordinary citizens in Hyderabad. Through this, it helps local businesses to get better services, goods, and jobs indirectly.

When you yourself are an owner of a business, CredRight provides you with an easy way to expand in full without the hassle of a property or an asset pledge. CredRight is also interested in financial literacy, where small businesses learn more about credit and repay responsibly. This can turn it not only into a lending vendor but also into a business partner.

Financial Services:

- Working-capital and micro enterprises (including ones that utilize or relate to chit funds) can obtain unsecured business / working-capital loans.

- Repayment history +ML/analytics Are used to make credit profiles of underserved businesses with no formal credit history.

- Loans in short term and term in reasonable numbers (e.g.1-35 lakh) with interest or EMI repayment terms.

- Digital / in-app onboarding, reduced documentation, quick loan approval / disbursement time ( 24 hrs to approve, 72 hrs to disburse)

4. AnyTimeLoan (ATL)

- Founded year: 2014

- Headquarters: Hyderabad

- Website URL: https://www.anytimeloan.in

AnyTimeLoan (ATL) is a peer-to-peer loans venture based at Hyderabad. It links the individual lenders with the borrowers by cutting out intermediaries known as customary banks. To the customers it implies more convenient access to such loans with terms depending on the customer. Through the platform, borrowers are in a position to obtain personal loans, education loans or business loans.

It is completely online and there is little paperwork, and disbursements occur within a short time. To the lenders, it provides a potential higher-yielding investment compared to the savings accounts or fixed deposit. The most fascinating feature of ATL is its accessibility and transparency that makes it attractive to customers. Borrowers are made to understand the transparent terms in advance such as interest rates and the schedule of repayments.

As the platform serves individuals who do not have access to conventional bank credit, the platform widows credit provision in Hyderabad. The overall warning to the borrower is to investigate the interest rates in detail, since at times P2P lending is higher than bank lending. Nonetheless, to people who favour dissimilarity and practicability, ATL may serve as a reasonable alternative to dealing with essential fluctuations over the short-term.

Financial Services:

- Peer-to-peer (P2P) lending: The linkage between investors and borrowers through an online platform.

- Immediately secured loans (personal, education loans, business loans) via 100% digital ecosystem.

- You can have the benefit of a FreePass (smaller limit, minimum requirements) or LoanPass (more due, EMI structure) with various eligibility and documentation.

- Lender / investor interactive product: enable individuals to view vetted borrowers, view returns, etc.

Suggested Read: Cash Credit Loan Apps

5. Basix Sub-K

- Founded year: 2010

- Headquarters: Hyderabad

- Website URL: https://www.subk.co.in/

Basix Sub-K is a financial inclusion company in Hyderabad. It is about delivering banking and financial services to individuals who have been historically marginalised through the system, particularly in the rural or semi-urban locations. Sub-K offers services such as savings accounts, micro-loans, remittances and insurance by having a network of agents plus digital tools.

To customers, it implies that important financial products are now in their back yards, and longer distance travel to a bank branch is unnecessary. Sub-K also assists migrant workers, daily wage earners, and small entrepreneurs in Hyderabad to receive services that they could not otherwise receive.

The company collaborates with banks and NBFCs to provide these services thereby making them picnic and more affordable. To their customers, the most powerful value added to Sub-K will be the convenience and trust. Most individuals prefer interacting with a local agent than filling in forms that are complex in banks.

Sub-K will enable individuals and communities to save, borrow, and plan the future by making all such activities easier to complete.

Financial Services:

- Micro-loans / credit services to financially excluded/ under-banked households.

- Financial inclusion products / savings services (collaboration with banks/ insurance etc ) to underserved segments.

- Insurance services plus pension facilitated through collaboration with banks/other financial institutions.

- Digital payments / fintech / transaction- services same platforms / networks: to facilitate transactions, disbursements etc to remote / rural areas.

6. Snapmint

- Founded year: 2015

- Headquarters: Mumbai

- Website URL: https://snapmint.com/

Snapmint is a Hyderabadi which is a fintech company with strong operations in the buy-now-pay-later (BNPL) model. When you go online shopping, odds are that you have noticed the Snapmint Pay in EMI at the checkout.

In case of customers, Snapmint can allow them to purchase smartphones, electronics, fashion, and home appliances in smaller monthly installments. The point of difference is that it offers a no-cost EMI option on many of its merchandise meaning you do not pay some additional interest. The process of getting the approval is fast and even customers with low credit history can become eligible.

This enhances the appeal of Snapmint to Hasson and students in amateur fields in Hyderabad that strive to have flexibility when it comes to cost management. Nevertheless, customers need to use Snapmint wisely like all the BNPL companies.

The overlooked EMIs might result in fines and influence the credit ratings. Snapmint is an easy-to-use tool when wisely used to regulate cash flow to afford larger purchases without having them due upfront financial strain.

Financial Services:

- Cardless online shopping and online checkout models with installment plans which do not use credit cards or bank cheques.

- Free EMI and low-cost EMI services will be provided to increase consumer benefits with lower prices (distort the price into a 3/6/9 months, etc).

- Merchant integration / white-label EMI checkout providers (merchants are provided with EMI integration tools to their product / cart pages, UPI-based EMI)

- On the spot approval / verification (mobile number + OTP), minimum paper work, quick at the cash office.

7. KFintech

- Founded year: 1978

- Headquarters: Hyderabad

- Website URL: https://www.kfintech.com/

A Finance company in Hyderabad, KFintech deals with asset managers, mutual funds, and investors by offering technology-based solutions. Although its services are usually running on the back side itself, they affect the customers directly who invest in the mutual funds or IPOs.

To customers, KFintech platforms also enable easier monitoring of investments, transaction processing, and proper collection of dividends or redemption of investments. Moreover, the company has favored the digital KYC, which enables fresh investors to get down to business without procrastinating paperwork.

The services KFintech manages cover some of the biggest mutual funds in India, which implies that your transactions are running on KFintech power, should you have invested in a fund. To investors in Hyderabad, this will give confidence to them that their money is spent efficiently and in a transparent manner.

Since the involvement of more youth in the city is increasing in investments, the role of KFintech is getting increasingly more significant in facilitating smooth and reliable experiences among millions of customers.

Financial Services:

- Mutual funds. Transfer agent Preparation of documents by mutual funds and corporate issuers.

- Fund accounting, fund administration, servicing and compliance of investors of asset managers.

- Digitized onboarding, origin or processing of transactions on several segments: mutual funds, alternative investment funds (AIFs), pension schemes, and so forth.

- There are channel management, SaaS-based technical/backend solutions to asset managers and institutional clients, and data analytics.

8. HighRadius

- Founded year: 2006

- Headquarters: Houston, US

- Website URL: https://www.highradius.com

HighRadius is a multinational fintech operation with an office in Hyderabad which focuses on AI-based financial automation. Although its core customers are large companies, consumers are the ultimate beneficiaries of improved and quicker service by companies with HighRadius users.

It has cash flow management, accounts receivable and treasury management tools. To a common individual, it translates to the fact that those companies implementing HighRadius have the opportunity to serve clients at a faster rate, cut on billing mistakes and enhance financial dealings transparency.

Besides that, HighRadius has made Hyderabad visible in the world of fintech. To clients, this not only generates additional employment opportunities in finance and technology but also elevates the city, as a destination, to a prestigious place as the spheres of innovative financial services.

Even though the HighRadius customers do not see and communicate directly with the HighRadius developments, its innovations influence how businesses run, including retailers and service providers, use money. This is being trickled-down to consumer improvement of financial ecosystems.

Financial Services:

- With accounts receivable automation (cash application, collections, deductions, etc) to accelerated order-to-cash times.

- Treasury & risk management tools: cash forecasting, liquidity management, payment processing, bank reconciliation etc.

- E-commerce and e-banking etc invoice presentment Corporate invoices Self-service payment opening E-invoice packages Invoice booking, self-service payment portal (EIPP) etc invoice payment at the beginning of the online movement Invoice booking, self-service payment portal (EIPP) etc invoice payment at the end of the online movement Invoice booking, self-service payment portal (EIPP) etc invoice payment at the end of the online movement Invoice booking, self-service payment portal (EIPP) etc invoice payment at the end of the online movement

- Integrations (e.g., payment support, card/ACH/debit/credit processing in SAP modules), international payment method support, with security / compliance (tokenization etc).

9. Alacriti Infosystems

- Founded year: 2005

- Headquarters: Hyderabad

- Website URL: https://www.alacriti.com/

Alacriti Infosystems is a finance companies in Hyderabad with emphasis in payment solutions and bill management systems. To customers, this implies a better user experience and lesser apprehension of paying bills, wiring money, or making online transactional payments.

The company supplies banks, utilities and businesses with solutions, which allow them to offer clients easier digital payment models. As an example, when you pay your electricity or water bill online, it is likely that platforms such as Alacriti are running the backend.

In the case of the residents of Hyderabad, this translates to a reduction in inconveniences and decrease in wastage of time in making thing-to-do payments. Security and compliance are also stressed by Alacriti, so all transactions remain secure and safe.

Through the modernization of the bill- payment systems, Alacriti ensures that the day-to-day lives of customers, who are gradually moving towards digital-first services, become simple.

Financial Services:

- Payments Hub / payment infrastructure – a single API to accommodate wires, ACH, instant payments and so forth.

- Unified Money Movement (transfers / payments / digital transfers) – providing institutions with the ability to have various money-movement rails in a single system.

- Electronic Bill Presentment/Payment (EBPP) – billing + payment interface, which assists the customer to view and pay bills online.

- Business to Consumer (B2C) payouts / digital disbursements – infrastructure that enables institutions to send out money (e.g. refunds, credits)

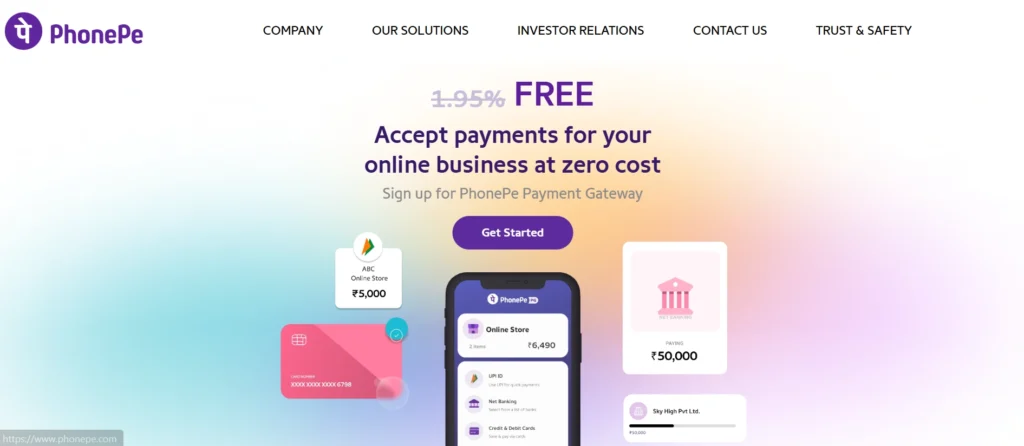

10. PhonePe (Hyderabad Operations)

- Founded year: 2015

- Headquarters: Bangalore

- Website URL: https://www.phonepe.com

Hyderabad is a key city of the exchanges performed by PhonePe due to it having one of the largest operational bases in the country, though the company is based in the city of Bangalore. PhonePe hardly requires any introduction to the customers.

Some of the largest digital payment platforms in India are commonly used to complete UPI transfers, mobile payments and bill payments, as well as online purchasing. PhonePe has integrated into the daily lives of millions of Hyderabadans with over 500 million users spread across the state of the country.

PhonePe has also developed insurance, mutual funds, as well as gold investment services on the app unless the payment is involved. To customers, this will allow you to deal with your day-to-day payment and longer-term financial products by opening accounts at a single location.

The acceptance of PhonePe cuts across merchants, small kirana shops, and major retail chains within Hyderabad making it one of the most user-friendly finance companies in Hyderabad. Its availability means that the residents are guaranteed to have fast, reliable, and secure digital transactions anywhere.

Financial Services:

- Digital payments / UPI / wallet / QR payments) – it is basic payments, money transfer, recharge bill payments, etc using their app.

- Lending (personal loans and merchant / business loans through agency through partner(s)) – they provide loans through partner NBFCs / agencies, digital KYC and open tenure.

- Insurance and financial products- sale of insurance schemes (auto, health etc) and other financial services through app marketplace.

- Investments / savings / mutual funds / digital gold – includes provision of investment products, liquid funds, purchase of digital gold in the form of an app etc.

Also Read: Finance Companies in Mumbai

Key Factors to Consider Before Choosing a Finance Companies in Hyderabad

Customers must select carefully because their choices of Finance Companies in Hyderabad are numerous. Always check:

- Clarity: Does the company provide clearly the rates, fees and terms of repayment?

- Convenience: Is it convenient to use digitally, or does it require going to an office?

- Regulation: Is the company registered under RBI or the SEBI?

- Reviews: Customer thoughts on how it worked out.

At least these things will allow you not to overlook any additional costs and make wiser financial decisions.

The Future of Finance in Hyderabad: What Customers Can Expect

The financial ecosystem of Hyderabad will further improve in the future. In the future, AI-based credit scoring, credit lines with UPI integrated, and more secure digital platforms of lending are set. Customers will have the guarantee of customised financial products, quicker approvals and transactions that are less risky.

As business management innovators such as HighRadius and CreditVidya drive growth, and companies such as payment powerhouses like PhonePe look for new markets, Hyderabad will keep leading the way in financial services in India. This benefits customers in the form of easier access to money, financial management, and peace of mind.

Conclusion

Hyderabad ceases to be in the list of IT parks and biryani only, the city is accessed as a financial powerhouse in which innovation can be met with accessibility. CredVidya and CredRight open the new gateway of borrowing, Payswiff andPhonePe ensure that digital payments are even faster, and with Snapmint, buyers can find a lot more opportunities than ever before.

What makes the city even more appealing is that these are truly customer-first finance companies in Hyderabad. Whether you want a small loan to invest in a mutual fund or a reliable way to settle bills, Hyderabad’s financial ecosystem has it all. The key is to carefully consider your options—compare interest rates, review eligibility checks, and choose among finance companies in Hyderabad that best fits your needs. With the right partner, managing your money in Hyderabad becomes not only easier but also smarter and more rewarding.

FAQs

Q1. What is the speed of taking up a personal loan in Hyderabad?

Financial technology companies, such as AnyTimeLoan or CredRight, will provide approval in 24-48 hours, compared to other banks.

Q2. Is the Hyderabad based finance companies safe to use?

Yes, faithful to as long as they are registered by RBI or by SEBI. It is always important to check before implementing.

Q3. Are small businesses of Hyderabad able to take in loans without security?

Yes, The CredRight and HardFork type of NBFCs do provide loans to MSMEs without

collateral.

Q4. Are my fintech apps safe with the aspect of my data?

The larger part of companies adheres to RBI, although there is always an advantage in downloading apps through the official resources.

Q5. How is alternate credit scoring (such as CreditVidya) good?

It enables individuals who do not or do not have credit history to take loans at an easier time.

Q6. Is it possible to invest safely by using Hyderabad based platforms?

Yes, enterprises such as KFintech will facilitate investments regulated by SEBI such as mutual funds.

Q7. What will occur in case I do not make a BNPL (Snapmint) payment?

You can end up being penalized and losing credit ratings. Always pay on time.

Q8. Are there gold loans by Hyderabad finance companies?

Although the city does not yet have a Rupeek based companion, there are other forms of conservative NBFCs such as Muthoot Finance at large scale locations in the city.

Q9. Would I be able to pay my entire bills in Hyderabad right away using only digital money?

Yes, there are such apps as PhonePe, Freecharge and services that work with Alacriti.

Q10. Which finance company should I use?

It all depends upon your necessity, whether that is payments (PhonePe), loans (CredRight, ATL), investments (KFintech), or daily-life purchases (Snapmint).