Mumbai is the Indian financial hub. It houses the Reserve Bank of India (RBI), the Bombay Stock Exchange (BSE), the National Stock Exchange (NSE) trading networks, the corporate centers of several leading banks in India, and the headquarters of offices of virtually all the large Indian-based financial institutions. This concentration makes Mumbai a prime center for financial services in Mumbai, offering deep capital markets, a massive repository of financial talent, and unparalleled access to regulatory and investor networks. The financial ecosystem of the city drives the delivery of credit, capital formation, insurance, and asset management in the region and throughout India.

One or two statistics in the headlines lead up to it. The Indian financial services area is on a rapid rise: mutual fund AUM has come to approximately ₹64.97 trillion (July 2024), and the insurance and asset-management divisions have a high growth rate. Analysts project that the assets under management of the financial ecosystem will continue to shoot up until 2030. Such an expansion needs banks, NBFCs, housing finance, asset managers, and specialized lenders, some of whom have establishments in Mumbai.

This guide profile includes 10 leading finance companies in Mumbai that have either the headquarters or major corporate centres in the city. The list contains universal banks, housing finance leaders, NBFCs, and specialised financial services companies – the type of companies that investors, job seekers, and partners normally consider when they refer to Mumbai finance. You will find, about each company, a brief history, what they do now, any strategic focus they have recently had, and why they are significant to the Indian financial ecosystem – along with the links to sources so that you can confirm information.

How We Choose The “Top 10”

I selected those finance companies in Mumbai that pass one or more of these tests:

- Massive scale of operation (AUM, loan book, deposits).

- National or pan-Indian presence and a sizable corporate presence of Mumbai.

- Well-known brand or market leadership within a specific segment of the financial (banking, housing finance, NBFC, corporate finance) sub-sector.

- Trusted public filings/company pages so that you can fact-check.

The 10 companies are discussed in greater detail below (in alphabetical order of company name): HDFC Bank (Housing Finance), ICICI Bank, Axis Bank, Kotak Mahindra Bank, State Bank of India (SBI), Tata Capital, Piramal Finance ( Piramal Enterprises / Finance ), IDFC FIRST Bank, YES Bank, and Bajaj Finance.

Mumbai’s Finance Ecosystem: Quick Context And Trends

Before the company prospects, it is worthwhile to mention the giant trends that are molding Mumbai in the finance sector toward 2024-25:

- Capital and Consolidation: Private equity and sovereign traders have been making massive investments in Indian banks and NBFCs (e.g., in private capital raises to mid-sized banks), but bigger banks are pursuing inorganic growth and consolidation.

- Retaliation of Finance: Rising home loans and personal loans, consumer finance, and rising mutual fund AUMs are altering business models. A great number of banks and NBFCs are placing significant focus on digital origination channels.

- Housing Finance, Affordability: Housing finance is a key industry; HDFC (housing) has traditionally dominated it, and in the housing bubble/banking entrepreneurship quadrant, mergers and structural discontinuities are redefining the platform.

- Tech & Fintech Integration: Many finance companies in Mumbai are increasingly collaborating with fintechs or developing a digital stack internally to onboard customers, accept payments, and provide loans. Two of them are fintech investment and the focus on regulating or digital onboarding.

- Regulatory Emphasis and Governance: RBI oversight with corporate governance and risk management takes priority in the (Mumbai) large finance houses because of the regulatory hitches experienced in 2020 during the crisis events (bank rescues, NBFC hiccups).

List of Top 10 Finance Companies in Mumbai

Each profile includes: what the company does, HQ/corporate centre (Mumbai), scale or key metrics (where publicly reported), recent strategic moves, and why the company matters.

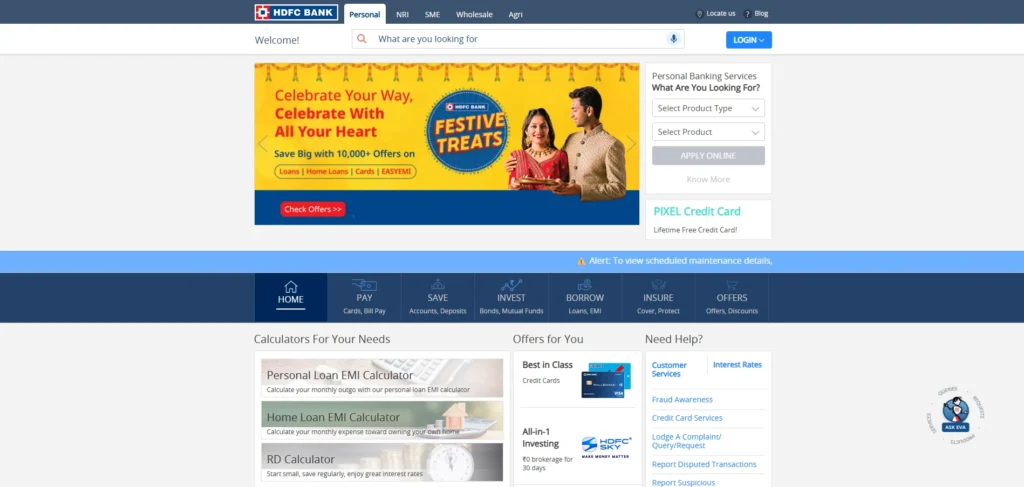

1. HDFC Bank

- Headquarters: Mumbai

- Founded: August 1994

- Website: https://www.hdfcbank.com/

HDFC Bank and HDFC Ltd, two of Mumbai’s leading financial institutions, have merged to create a more robust and comprehensive banking and housing finance entity. HDFC Bank, a private sector banking giant, offers a wide spectrum of services including retail and corporate banking, treasury, wealth management, credit cards, and a fast-growing digital portfolio. Its corporate presence in Mumbai, including offices like Ramon House and HDFC House, anchors the bank’s executive, treasury, and corporate operations. Over the years, HDFC Bank has focused on digital adoption, risk-adjusted credit growth, and branch-digital expansion, making it a market leader across multiple banking metrics.

HDFC Ltd, historically India’s largest housing finance company, pioneered organized mortgage lending and long-term home loans. Its Mumbai headquarters continues to influence the nation’s housing finance landscape, shaping product pricing, affordable housing strategies, and loan management practices. The merger of HDFC Ltd into HDFC Bank has integrated housing finance with comprehensive banking services, enhancing operational efficiency, risk management, and customer offerings.

Why it is Important: The merger strengthens India’s financial sector by combining HDFC Bank’s broad banking expertise with HDFC Ltd’s housing finance legacy. This integrated entity sets industry standards in retail banking, mortgage lending, and corporate finance, influencing market trends and offering customers a unified, trusted financial platform.

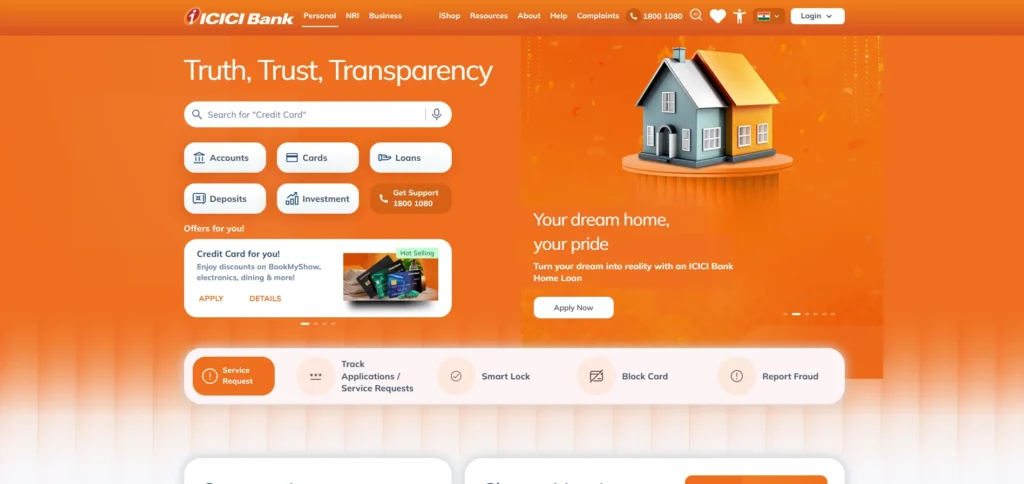

2. ICICI Bank Ltd

- Headquarters: Mumbai

- Founded in: 1994

- Website: https://www.icicibank.com/

ICICI Bank has its place among the biggest banks in India that provide a wide range of financial services: retail banking and corporate banking services, investment banking services, asset management services, and insurance distribution services. The national scope and listed position of ICICI Bank make it one of the key participants of financial markets in India, and the Mumbai corporate base generates sufficient investment relations, corporate banking, and deals on a large scale to satisfy the needy investment relationships.

ICICI has been the leader in digital banking, mass-scale retail lending, and term lending to corporations. The previous experiences of the group as a development finance institution gave it an edge in corporate credit, whilst the subsequent shift to retail converted its deposit and retail loan base. ICICI Bank has also made investments in technology for the acquisition of customers and has acquired market share in its lending areas, such as mortgage lending, personal loans, and small business finance.

The product spectrum, branch network, and milestones are covered by the public filing of the bank as well as by the pages such as About us. Partnerships, digital, and corporate capital management-related strategic actions of ICICI are commonly cited as an industry benchmark in the banking industry.

Why it is Important: The magnitude of ICICI Bank, the size of its operations in capital markets, and the variety of its products that it offers cause this bank to be a central institution within vital Mumbai finance.

Also Explore: 7-Day Loan Apps

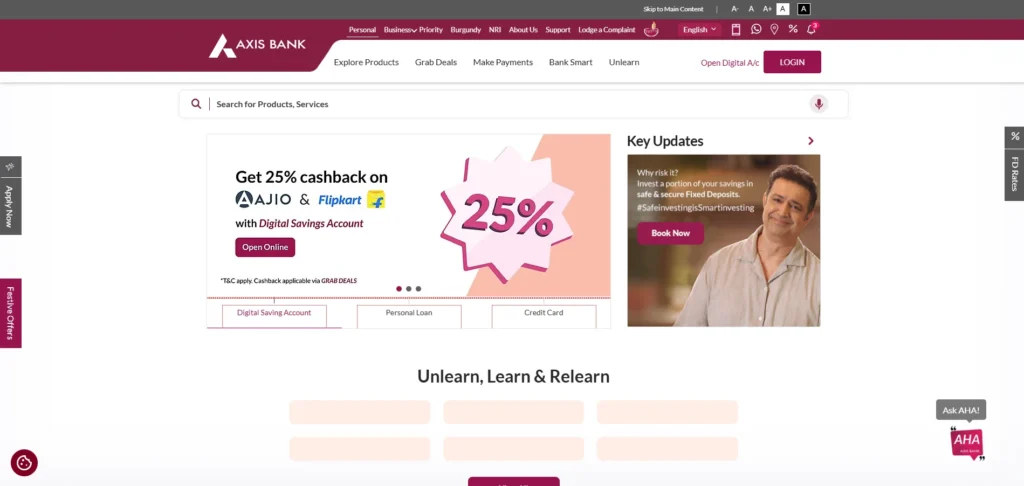

3. Axis Bank Ltd

- Headquarters: Mumbai

- Founded: 3 December, 1993

- Website: https://www.axisbank.com/

Other popular banks in India that are in the private sector business and in which Axis Bank heavily competes include full-service banking products full service, which deal with retail banking, corporate banking, treasury, and wealth management products and services. Its corporate and executive base operation in Mumbai organizes gigantic corporate relations, capital markets operations, and payment systems, positioning it among the leading finance companies in Mumbai. After a period of balance sheet fortification, Axis has placed a focus on the growth of retail assets, digital platforms, and the improvement of operating measures.

The approach that Axis currently takes usually integrates corporate loaning and retail growth, which the company has also invested in technology to scale digital onboarding and payment, should there be. It provides the address of the Axis corporate office and distribution, corporate governance, and presentations to investors on their public corporate pages. To the market, Axis is one of the large competitors in the private banking arena and has indicated the performance of both the cycles of retail credit demand and the corporate credit.

Why it is Important: This is because the scale of Axis Bank in retail and corporate business segments, as well as its ratings in Mumbai, makes it a major participant in financial flows in the country.

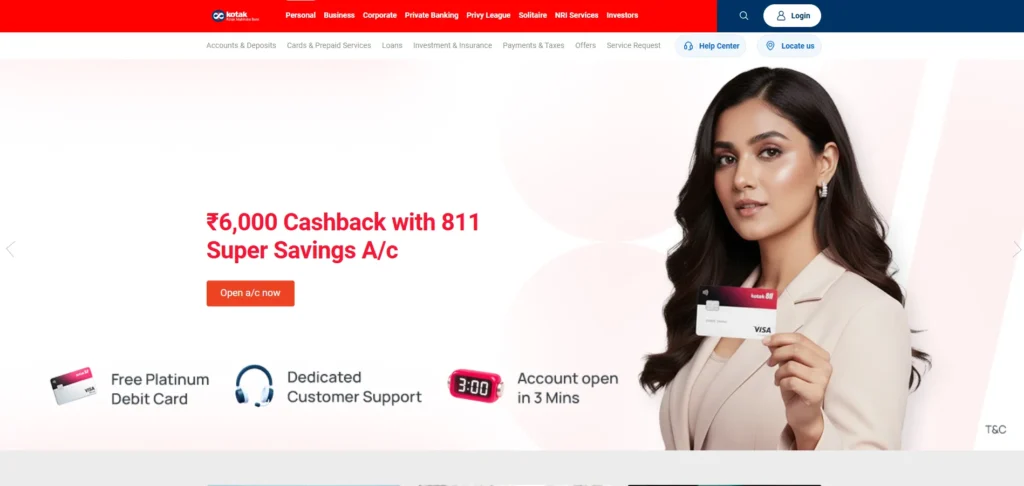

4. Kotak Mahindra Bank Ltd

- Headquarters: Mumbai

- Founded: 21 November, 1985

- Website: https://www.kotak.com/en/home.html

Kotak Mahindra Bank started as a finance company and further became a universal bank; in the current times, it provides banking services, asset management services, investment banking services, insurance, and capital markets services. Kotak’s story of growth has seen its shift in NBFC mode of operation to the model of full-service banking with both organic growth attitudes and focused acquisitions, as noted by the registered offices, which are located on their company site (Mumbai). The investor disclosure by Kotak and the corporate pages of the company explain the registered offices as well as the major company groups.

The primary focus of Kotak has been the acquisition of retail customers, healthy risk management, and fee-based available revenues (wealth, cards) – the reason why many people view Kotak as a high-quality franchise within the Indian private bank sector. It has also, over an extended period within the past few years, undergone regulatory scrutiny that has resulted in specific changes to it (such as onboarding restrictions during a certain point in time) and follow-up corrections.

This kind of action demonstrates how tricky growth and administration at the scale of a bank with headquarters based in Mumbai can be. News of the regulatory action and corporate activity on Kotak is part of the regular reporting in business publications and investor reports.

Why is it relevant that Kotak is an Indian capital markets and wealth-management franchise due to its conversion into a universal bank and its headquartered in Mumbai?

Rigor: Registered offices of Kotak Mahindra Bank and investor resources.

5. State Bank of India (SBI)

- Headquarters: Mumbai

- Founded: 1 July, 1955

- Website: https://sbi.bank.in/

SBI is the biggest bank in India in terms of assets, and operationally, the Head Office of the bank facility is in State Bank Bhavan, Nariman Point, Mumbai, State Bank Corporate Centre. Being a giant in the public sector with intimate retail and corporate coverage, SBI has a systemic contribution to the supply of credit, state banking, and stability of the country. Indeed, among finance companies in Mumbai, the big network of branches and relations with the government provides SBI with consideration as one of the key players of the Indian finance system.

The Mumbai centre of the corporate relations team at SBI liaises with its international banking operations and market relations. It is also a huge channel of government banking trade and massive infrastructure funding. Entrepreneurs will also find the credit footprint and support of the government, spreading that of SBI, can be crucial in evaluating the cost of funding the project; to savers, the SBI is a reliable brand in households as a banking entity. The bank also has public pages where information is available on the corporate office and statutory disclosures.

Why it is Important: The scale of SBI, state connections, and national access may be systemic in the financial objectives of the Indian economy.

6. Tata Capital Ltd

- Headquarters: Mumbai, Maharashtra

- Founded in: 2007

- Website: https://www.tatacapital.com/

Tata Capital is the source of financial services in Mumbai offered by the Tata Group, which consists of consumer loans, wealth management, SME finance, project finance, and structured lending. Tata Capital is based in what is called Lower Parel, Peninsula Business Park, Mumbai, combining both the Tata group and a wide range of products that appeal to retail and institutional clients. Tata Capital is involved in consumer finance (personal loans, used car finance), structured lending, and distribution of financial products.

The financial ecosystem comprising Mumbai and the Tata Capital is are natural habitat: the physical proximity to the corporate offices of the Tata group, the relationships with the investors, and the corporate clients serve the company in the structuring of the large-ticket financing and cross-sell group services.

Tata Capital product pages and investor information display its address offices, leadership, and business divisions. It has a credit propensity to retail expansion, company, and infrastructure banking, but aims at ensuring governance aligned to the Tata brand.

Why this is Important: Tata Capital has a brand, product, and distribution diversity, which makes it a competitive non-bank finance option in Mumbai and the rest of India.

Suggested Read: Home Loan Rules and Regulations in India

7. Piramal Finance / Piramal Enterprises

- Headquarters: Mumbai

- Founded: 11 April, 1984

- Website: https://www.piramalfinance.com/

Piramal Enterprises (with its Piramal Finance business division) is a mixed financial-services company, engaged in wholesale lending, retail lending, and investment solutions; it is also invested in the healthcare sector and others. Piramal Group has a company presence at the Mumbai tower (Piramal Tower and associated offices). Historically, Piramal Finance concentrated its attention on the consideration of such types of lending as structured lending, the affordable housing financing segment, and on the service of retail financial products through the Piramal Housing segment, as well as Piramal Capital.

Piramal has also recently been taking action to consolidate its financial services business and transform its retail-lending play. The investor pages and corporate contact pages of Piramal define the business verticals and addresses of offices, business-specific press reports such as business enterprises, capital-raise initiatives, mergers, and partnerships.

A combination of wholesale finance (private credit, special situations) and a growing retail presence on Mumbai capital markets lowers investment risks through capital relations combined with an expanding retail footprint in the country, equivalently broadening such ratios.

Why this is Important: Piramal Finance combines its own set of solutions in retail finance with its own set of solutions in private credit, combined with that of its Mumbai corporate base, placing it on the key mid-market financier list and as an alternative credit provider.

8. IDFC FIRST Bank Ltd

- Headquarters: Mumbai

- Founded: October 2025

- Website: https://www.idfcfirstbank.com/

IDFC FIRST Bank is a relatively new universal bank that is the resultant merger between the IDFC Bank and Capital First; its leadership is based in Mumbai (a major corporate address is the Bandra Kurla Complex). With a large base of retail-deposit building combined with infrastructure and corporate financing background, IDFC FIRST Bank is a hybrid franchise that has both retail and wholesale credit strengths. Recently, the bank has received considerable interest from large-scale private-equity companies to increase its balance sheet and loan book.

The IDFC FIRST Bank has aimed at the retail credit growth, acquisition of customers digitally, and developing its branch-plus-digital model. The bank can also use its project and infrastructure lending (through its IDFC background), and the bank has acquired this, giving it a multi-segment presence, which is inherent to the Mumbai high corporate client group.

On its corporate pages, the Bandra Kurla Complex office and the investor information are listed. The recent increase in capital and its strategic investments accentuate its plans to expand the loan book and enhance digital capabilities, further strengthening its position among leading finance companies in Mumbai.

Why this is Important: The combination of retail development and infrastructure development has put IDFC FIRST Bank on the map as a key up-and-coming player in the Mumbai-based party.

9. YES Bank Ltd

- Headquarters: Mumbai

- Founded in: 2003

- Website: https://www.yesbank.in/

YES BANK is a private bank that has corporate activity in Mumbai. Following a very publicized Nov. 2020 stress situation and subsequent rescue plan, through the RBI and a group of banks, YES BANK has been reconstructed on a different governance structure and capital base. It has a corporate centre in Mumbai that facilitates major corporate relations, and a retail network that provides a range of financial services in Mumbai, including deposits and lending.

The post-takeover plan of YES BANK focused on fixing the balance sheet, being cautious with risks, and having a measured expansion in corporate and consumer end borrowing decisions. The services of retail banking, wholesale banking and payments, and investor relations have updated information on the corporate site of the corporation.

In the context of the financial ecosystem of Mumbai, the case study of the reorganization of YES BANK underwent a high-profile reorganization and therefore an issue based on crisis management, resolution of the crisis led through regulating authorities, and the establishment of trust afterwards in dealing with the firm.

Why is it Relevant that: YES BANK re-emerging and in business in Mumbai illustrates how a substantial personal bank can be stabilised by government regulation and by infusion of capital.

10. Bajaj Finance Ltd.

- Headquarters: Pune, Maharashtra

- Founded: 25 March, 1987

- Website: https://www.bajajfinserv.in/

Bajaj Finance Limited was established in 1987 and is headquartered in Mumbai making it one of the most diversified and fastest-growing NBFCs (non-banking financial companies) in India. The company is one of the divisions of the Bajaj Group that has established a robust consumer lending business, small business lending, vehicle and durable goods financing business, and, more recently, a digital financial services business. It owns branches in the Indian states and has tight relations with local merchants and e-commerce websites.

A combination of breadth and agility is the business model of Bajaj Finance. It provides various products, such as consumer loans ( consumer appliances and consumer durabilities etc.), personal loans, small medium business (SME) financing, financing of consumer durability, and wealth management and investment products. Underlying its strategies have been the company’s heavy investment on the technology based underwriting which has highly taken advantage of the data analytics that enables quicker credit-based decisions and low rates of default. It has a wide range of customers, including urban, semi-urban and rural locations, although Mumbai is one of the nerve centers of leadership, business operations, investor relations and alliances.

Over the past few years, Bajaj Finance has concentrated on how to reach more people online, add mobile-first lending, PayLater products, and increasing cross-sell opportunities based on the many current customers. It has further strived to ensure good capital adequacy together with sound management of risks, which are considered strengths by analysts within the NBFC industry particularly due to the banking-wide shocks generated on credit markets. In the latest quarterly results the growth of its loan book is healthy and the quality of its assets is stable. Bajaj Finance is a blend of the brand, size, and technology in the NBFC environment in Mumbai, to both lenders and borrowers.

How To Evaluate A Finance Company In Mumbai

In selecting which finance company to do business with, be it business finance, as in the case of a home loan, or corporate finance, or as in the case with investment services, consider the following:

- Disclosures Regulatory Status: Check RBI / SEBI filings and new annual reports. Financials, risk disclosures, as well as governance notes are published every quarter by large banks and NBFCs.

- Product Fit: What you require a product to do well with- Banks work well with deposit-based services when it comes to broad lending specified; NBFCs can work well with shorter-term disbursal services when it is necessary; housing finance companies are specialty-based on their long-term mortgages.

- Customer Service & Experience: Customer response (reviews), time taken for customers to get loans, and dedicated mobile/online customer service are significant factors to retail customers of finance companies in Mumbai.

- Pricing and disclosure: See rates, fees, prepayment charges, and penalty requirements (particularly on long-term loans only).

- Track Record/ Client References: To fund big companies, request case studies or reference customers; retail lending. Read customer reviews where you have and net promoter scores where you have.

- Capital Strength: Banks and NBFCs. To determine the resilience of a bank or NBFC, look at its CRISIL/ICRA/Moody’s/Fitch ratings and capital adequacy ratios– helpful to see the capital strength.

Check the company’s investor relations web pages, RBI/SEBI reports, and independent rating agencies’ reports to check the claims. They are official and government-mandated due diligence.

Sector Risks And What To Watch In 2025-26

- Macro & Interest-Rate Cycles: The increase in global rates can push the demand for loans and the price of assets; track the changes in RBI policy.

- Asset-Quality Risk: Monitor and unsecured retail portfolios, and can respond to stress in bad times.

- Regulatory developments: cost and business models are influenced by regulatory amendments, i.e., changes to RBI and SEBI policies (KYC, online onboarding, capital requirements).

- Geopolitical Flows and FDI Flows: Mumbai, being a capital city, enjoys FDI and institutional flows; variations in worldwide capital markets influence deal flow to Indian banks and other NBFCs. (Press Information Bureau)

Conclusion

Policy makers of the financial sector in Mumbai are the finance companies in Mumbai, which include big universal banks, small NBFCs, as well as specialized lenders providing credit to the housing sector. The ten companies described (HDFC Bank, HDFC Ltd, ICICI Bank, Axis Bank, Kotak Mahindra, SBI, Tata Capital, Piramal Finance, IDFC FIRST Bank, and YES Bank) collectively influence much of the sector’s size, operations, and government oversight that characterizes the current state of the finance industry in India.

When considering lenders, a Mumbai-based partner or employer, then this list may serve as an entry point: be prepared to check company filings, scan product descriptions on company websites, and verify regulatory qualifications either on RBI/SEBI or investor relations sections of companies.

FAQs

Q1. What is the Quickest Issue With a Home Loan that these Finance Companies Make?

The quicker disbursement by the NBFCs and specialized housing financiers (as well as by banks with pre-vetted products) depends on the credit profile and documentation; so, precise timelines are not given. Get product comparisons and reviews.

Q2. Are the Prospects of Getting Corporate Credit in Mumbai Better in Comparison with Abiding in Other Cities?

The location of corporate banking teams, capital markets, and investor relations of Mumbai can accelerate large-ticket syndication and structuring; however, it is critically based on the underwriting regulations of a lender.

Q3. Checking the Safety of NBFC or Housing Finance Companies?

Seek RBI registration (where necessary), credit ratings of agencies (CRISIL/ICRA), capital adequacy, audited financial reports, and disclosures of compliance. The most important are public filings and reporting by rating agencies.

Q4. Which of These Companies is Most Recommended in Relation to Lending to SMEs?

Compare product pages, qualifications, and prices.

Q5. Are There Locations Where I Can Read Corporate Annual Reports?

Most likely, the main place (linked in Sources below) is the company’s investor relations pages. In the case of banks, audited financials are also included in the RBI as well as on the stock exchange filings.